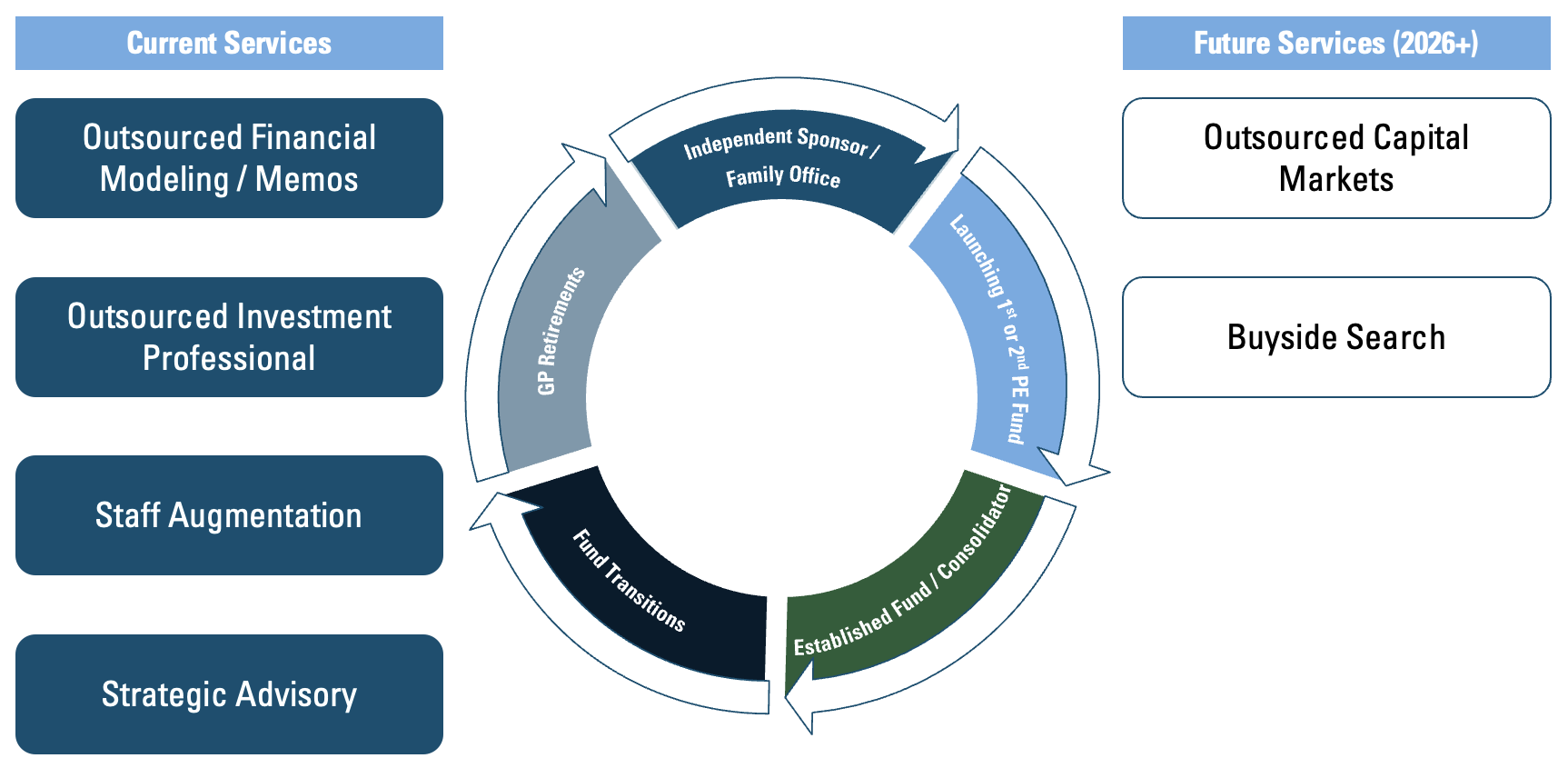

Private Equity Life-Cycle

Launch Growth Partners provides outsourced & interim support and strategic advisory for private equity firms throughout their life-cycle

The Catch-22

The economics associated with starting a private equity firm often places investors in an uncomfortable catch-22, where you need to raise capital in order to invest, but you need to invest capital and prove out your investment strategy in order to fundraise…not to mention the fact that you need to hire a team in order to execute on any of this…so how do we pay for all of this?

Launching a PE Fund

During the first fundraise, private equity firms are faced with the challenge of staffing their team, while their sources of working capital are largely variable.

For a new fund, raising fund capital is often a slow process, and in today’s environment, the process can be even slower, requiring several meetings and quarterly allocation periods and driving numerous soft closes for new fund managers over 3-4 years

This places fund managers in a bind, leveraging initial capital to close investments and fund working capital. But initial management fees may not be enough to cover the fixed costs of a full team. So which resources do we choose to finance? What if we didn’t have to choose?

So…What are my Options?!

There are multiple paths to building your team while early in your fundraising cycle; however, most of them require sacrificing equity, fund economics and / or cash-flow

Enables you to hire your investment team immediately

High-interest rate environment will impact cash flow and ability to scale, thereafter

Potentially sacrificing economics

Take Out a Working Capital Loan

Enables you to hire your investment team immediately

It’s difficult to value an early-stage PE firm

You lose equity in the GP

Likely sacrificing economics

Sell a Minority Stake in the GP

Enables you to pursue investments immediately

Contract on an as-needed basis, aligned with your pipeline and management fee budget

Defer some, or all of your fees to the funds flow as reimbursable transaction expenses

Focus your initial personnel budget on drivers of early success: fundraising, sourcing, relationship building, and value creation

Contract Launch Growth Partners

STRATEGIC ADVISORY

Where to Focus My Internal Resource Budget

So you’ve made it past the initial fundraising hurdle and can now start building out your team. But which parts of your team should you prioritize?

Key Team Building Questions

-

How complex are the business models that I invest in?

-

How robust is my sourcing funnel? How proprietary is my sourcing strategy?

-

How complex is my investment strategy?

-

How complex is my value creation strategy?

-

How sophisticated are my portfolio companies at the time of acquisition?

-

Is my strategy focused more on organic growth or M&A?

Key Fundraising Questions

-

What types of my investors will be most interested in my fund?

-

What elements of my strategy attract investors (i.e., downside protection, organic growth, M&A, dividend yielding, duration, J-curve, speed of deployment, holding period, etc.)?

Key Scaling Questions

-

What is the maximum addressable market for my investment strategy?

-

Will my strategy continue to work at a larger fund size?

-

Will my strategy continue to work with larger check sizes?

-

Will my strategy continue to work in new industries or geographies?